FWA: Part 1 – Broadband Market Impact

The 1st in a series of articles on FWA. The 1st will focus on where FWA has found success. The 2nd post will focus on capacity, with a 3rd/4th on FWA at maturity and cables' competitive response.

FWA, or Fixed Wireless Access, continued to eat up the majority of broadband connects in 2023, with T-Mobile and Verizon reporting ~7mm FWA consumer and business connections as of Q3 2023 (there were close to 0 prior to 2021). Telcos aren’t getting much credit for FWA though, as the economics are (significantly) inferior to their traditional wireless plans, and the growth runway is expected to be relatively short due to capacity limitations. Where FWA has had an impact on valuations is competitors, mainly legacy cablecos; cables’ broadband growth has evaporated and margins have been pressured as FWA currently gets >80% of the industry’s adds. Both CHTR 0.00%↑ & CMCSA 0.00%↑ traded at ~11x EV/Ebitda in 2020, but now trade closer to ~7x.

I’m going do a few posts on FWA (maybe 3 or 4); this post is going to dig into FWA’s impact on the broadband market, specifically where they’ve had success and why. I’m going to upload another article later this week on network capacity, then maybe another one on FWA at maturity, and a final one on cables’ response (wireless and promos).

FWA’s growth, and its impact on cables’ performance (broadband adds and ARPU pressure), is the main reason I sold my Charter position.

FWA Growth

FWA is currently the only new way that telcos have managed to (materially) monetize their 5G networks; they spent 100s of billions of dollars buying spectrum and upgrading cell sites, but ARPU for traditional wireless plans are flat and the hype around other potential use cases has died down (autonomous cars, private networks, virtual reality etc.). This has left them pushing FWA in an attempt to earn a return on their investment.

And it’s worked, T-Mobile and Verizon added ~900k FWA broadband connections in Q3, while the rest of the industry was basically flat – fiber connects roughly match copper losses and cable has stopped growing. This is a reversal from 2018-2021, where cablecos were responsible for ~100% of net adds.

FWA’s growth has been concentrated in a few different areas:

Small business

Rural

Price sensitive customers

No one pretends FWA is a better way to deliver data (wire to the home with fiber or cable), but it’s proven to be an acceptable alternative. I’ve changed my mind on FWA; my original thinking was in a world that increasingly relies on connectivity (your house needs an internet connection as much as a front door these days…), the risk of an inconsistent connection and lower performance was not worth it to save a few bucks (not to mention capacity considerations for providers). I still think this personally, I’d much prefer a fiber or cable connection to my home for $2-3 a day, but a significant portion of the country disagrees with me; many are happy to substitute a wired connection for a simple wireless product with reasonable speeds and no long-term contract.

If we believe FWA is currently an acceptable alternative to wired cable or fiber, the next question is how far can it go (how much demand and supply is there)? We’re going to look at network capacity (supply) in the next article; first, we’re going to focus on where FWA has had success, and if there’s likely to be longer-term demand.

Small Business

FWA has been hugely popular with SMBs; it’s portable, easy to set up, provides lower tier cable type speeds (~100mbps), and offers the flexibility these businesses value (e.g., no contracts). This popularity has shown itself in a few ways. First, it’s expanded the TAM; think a food truck or construction site that either went without broadband or used a legacy wireless technology, now FWA is a great option (some businesses also have FWA as a backup option for their wired connection).

Second, it’s won business from SMBs who have low-capacity needs but are getting charged a lot more than a classic residential plan. This would be stores like your nail salons or hairdressers; businesses that need a solid connection, but their capacity requirements are similar, or even lower than a residential home. Traditionally, wired competitors have charged ~35% more for an SMB connection vs residential (using Charter’s Residential vs SMB ARPU as a proxy); FWA offers these types of businesses a simple self-install product with adequate performance, all for a cheaper price.

This popularity has shown up in the numbers. Verizon has a 60/40 consumer vs business split for their FWA product (T-Mobile doesn’t disclose breakdown); a standard split would be closer to ~90/10. This is an area where FWA should have a long growth runway. It’s a great option for SMBs, a reasonable use of capacity for telcos (low-data requirements), and an area with lots of activity that should allow for opportunities to win connections (lots of businesses are started each year). I see continued demand for FWA from SMBs.

Rural

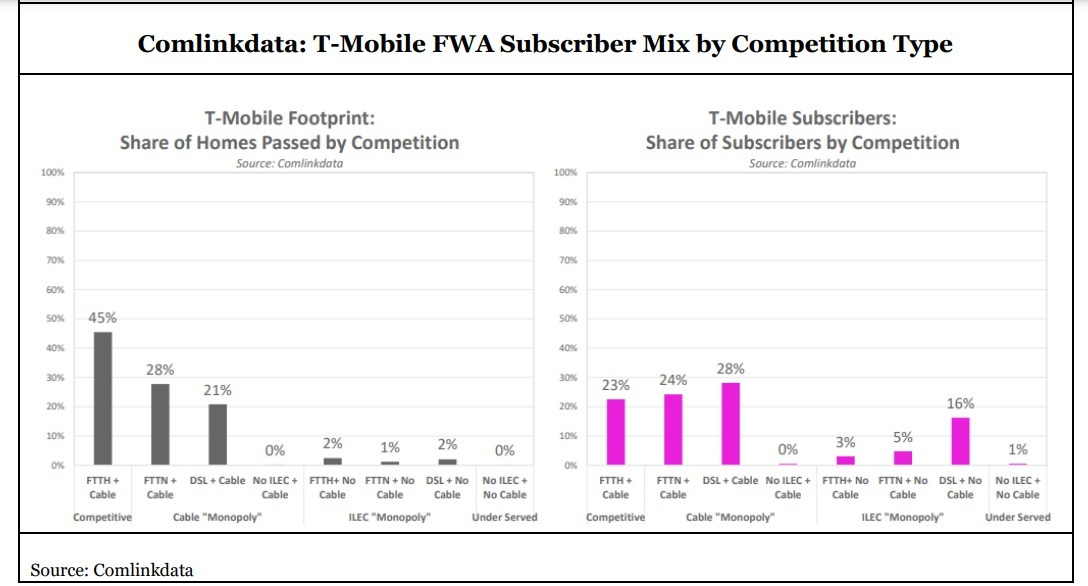

FWA has consistently over indexed in rural locations since its launch in 2021 (T-Mobile), but it’s also where telcos are less likely to have the infrastructure (less dense network and towers potentially not even upgraded with 5G equipment). So, what we’ve tended to see is a larger amount of urban and suburban homes that offer 5G, but a lot more activity in rural footprints when it’s available. The chart below is from early 2022 but shows ~25% of T-Mobile’s FWA’s subscribers were from ILEC Monopoly footprints (I’m going to use this as a proxy for rural), which made up only ~5% of their homes passed.

This is backed up by some more recent analysis by New Street Research, which:

“found that close to 20% of FWA gross adds are new to broadband; almost double the share for the broadband market overall… New Street noted that subscribers who come to T-Mobile and Verizon are also drawing heavily from households that were previously wireless only.”*

*I’m assuming homes that are new to broadband or were wireless only (this analysis focused on residential), are more likely to be rural.

Rural is another area where FWA provides a lot of long-term value imo (and is most scary for cablecos). T-Mobile classifies rural as ~50mm homes and ~40% of U.S. households. Capacity, the main concern for FWA, is less likely to be an issue in rural locations and the new high-margin revenue can change the economics of tower buildouts; there’s little stopping telcos like T-Mobile or Verizon from densifying in rural areas if it’s profitable to do so.

The economics for densification are most likely to make sense in wired monopoly footprints, where customers are dissatisfied and pay a high price (Cable One type footprints). The calculation for the telcos looks different with a reasonable FWA penetration assumption and $50 ARPU. There’s obviously risks and considerations like other competitors potentially densifying as well, and the overall density of the population, but I think we see increased competition in rural monopoly footprints longer-term (where cablecos have historically had little competition).

Price Sensitive Customers

Most potential FWA customers, in general, are price sensitive; they’re taking an inferior quality service to cable/fiber for a cheaper price, but it still provides adequate performance for most average homes (>100mbps speeds). We’ve discussed SMBs and rural above, but price is a big enough category to warrant its own discussion.

A TD Cowen survey found that ~50% of cable customers would be open to switching to FWA if it was cheaper (even knowing it provides slower speeds); this percentage increases to ~67% if the customer is using DSL. Sure, it’s one thing to say you’re willing to switch and another to go through the hassle of returning CPE and cancelling a contract etc., but this number is alarming.

Cable companies have started to provide details on where they’re seeing an impact from FWA. Charter and Comcast have mentioned on multiple calls that FWA has not had a large impact on churn, but has shown up in their gross adds (i.e., FWA is winning new share vs taking share directly from cable - the net number is the important number here anyway). Interestingly, in Q4 2022, Charter highlighted higher churn in their MDU footprint:

“When some pricing actions were taken in December, we saw for the first time a very limited impact on our voluntary churn, but not where you would have expected it. It's actually in our non-gig overlap and in our MDU footprint where you have higher churn to customers, higher tendency to move around, higher tendency to non-pay.”

I read this as your classic MDU type renter, maybe someone in their first job out of college and is open to using FWA, especially after their wired promo expires (classic cable promo is ~$50 for the first year and jumps up to $75 for the 2nd). Add in Comcast’s negative adds during Q3 2023, a quarter that usually provides a tailwind with the back-to-school connection pool, and I think we’re starting to get a picture of the “price sensitive” customer FWA appeals to - college age or young 20 somethings, living in apartment complexes and open to trying new technology.

Bottom line, a significant amount of the population are open to FWA if it saves them money, provides adequate speeds, is simple to set up, and requires no contract/commitment.

Summary

To bring this back to earth - when you ignore capacity it’s easy to get carried away with FWA’s prospects (low cost provider and share taker) - FWA won’t be a product for the masses, a wired connection is just a better way to deliver large amounts of data, and capacity puts a ceiling on how much home broadband traffic a wireless network can absorb (we’ll dig into capacity in the next article). However, FWA has clearly gotten over the first hurdle by showing there’s demand for the service as a low-cost option. This is a big change to the traditional broadband market, not just because it’s created three new competitors (T-Mobile, Verizon, and to a lesser extent AT&T), but also because of how they compete.

They have two advantages vs wired competitors. First, they don’t need a wire into a home to provide their service which provides a cost advantage (this comes with the drawback related to performance). Second, the calculation, especially in rural areas, allows them to sell two services that use the same infrastructure (traditional wireless and FWA), and the services do not necessarily cannibalize each other.

This has changed broadband from a monopoly/duopoly type market, to, in some cases, a 4/5 player market. Even if you don’t think FWA has a long runway, the impact of additional competition has a habit of being underappreciated (I consider myself guilty of this). Next we’ll cover capacity, the biggest question mark surrounding FWA.

I think FWA will be a competitor and serve a certain cohort of the market but I think that’ll really be on the margin. If you look at the amount of capital that the telcos have deployed into their network, with little to no incremental cash flow being returned (at least for T and Verizon - haven’t looked at T-mobile) I would suspect that their shareholders, and management, would stop short of making a big push into the broadband market because of the capital spend that it would require to increase network capacity. It’s a low return business and they’ve already deployed a couple hundred billion dollars collectively with no growth in cash flow. It’s staggering when you run the numbers. Therefore, I don’t see them making a big push beyond their announced plans.

Personally, I like the investment in Charter through Liberty Broadband because you are getting mid-teens free cash flow yield on a normalized basis (ex. growth capex) which I believe more than compensates for the risk taken. It always comes down to what price am I paying for the risk assumed and I’m comfortable with the long-term competitiveness of Charter. Lastly, I think Charter competes very well on a cost and service level with FWA.

Thanks for sharing. I look forward to the remaining series.

Question regarding pricing of FWA plans vs cable for like speeds. Is FWA really a low cost provider? I don’t believe that’s the case in urban and suburban markets where you have density of network and customers. So is that an advantage only in rural?

Either way, is cable (specifically Charter) lowering prices to compete? In my view, I don’t see the telcos having an enduring low cost advantage over Charter specifically. I’m surprised that Charter has been slow to respond.

Curious on your thoughts. Thanks!