Q2 2023 Charter Update: Positive Signs for Cable?

This was a positive quarter for $CHTR, growing subs in their core footprint during a slower seasonable period. In this update we also cover some of the key bear case concerns.

Every quarter I find myself looking at the stocks I own and having the same, usually panicked, internal conversation; If it drops, I think things like:

“Am I wrong?”

“Am I crazy?”

Then I’ll justify:

“The market’s inefficient, it’ll turn around.”

“I made the right bet, odds were in my favor, maybe I was just unlucky.”

When they move in my favor, I put my shoulders back and pretend I always knew I was right:

“I’m a long-term investor, I was patient and right.”

“Great bet, the market is catching up.”

I say all this because I think most of us judge the market (usually with a hint of arrogance, after the fact, and usually behind some Buffett quote), pretending we always knew stock xyz was going to go up or down; in reality, we look to the market for justification and, even if we know it’s not bad theoretically, we panic if our stocks dive. Acknowledging it half the game.

The Quarter

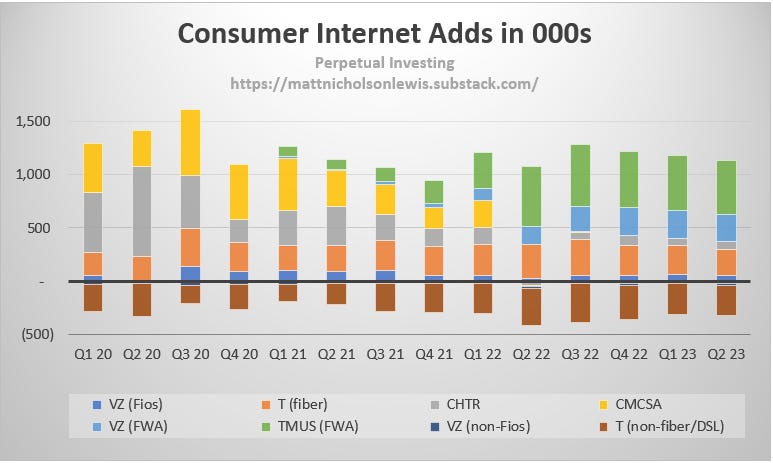

Investing in cablecos has been a great way to get some reps in (re. a stock diving), with each quarter bringing a new reason to panic over the 18 months. This quarter was a change of pace with quite a few positives; CHTR 0.00%↑ added ~75k subs during a slower period (snowbird and college disconnects), and only ~25k of those adds were through their rural initiative; last year they lost 42k customers, or added ~17k when adjusted for the 59k disconnects from the termination of government programs (EBB and ACP).

The SpectrumOne promotion is working ($50 for internet and mobile). Management disclosed the majority of SpectrumOne deals are still from existing customers, with ~11% of their customers signed up for mobile. This has helped reduce churn but put downward pressure on APRU. A negative from the quarter, management’s answers to ARPU questions were painful. Instead of a straightforward answer like:

“ARPU is roughly flat due to the SpectrumOne promotion, video disconnects, and more customers choosing skinny bundles, offset by price increases. We expect ARPU to return to growth in (insert when), as SpectrumOne promos start rolling off.”

They went with an explanation about lots of moving pieces like autopay discounts, lapping programming increases, bundle allocations, and came up with 2.5% increase for internet ARPU growth. You’re selling a $50 promo for internet and mobile, signing up >600k mobile lines a quarter (all customers eligible)! Your promo is working, that’s why ARPU is pressured…

Back to the positives. Management’s comments around slowing fiber builds, along with AT&T’s fiber adds decelerating (251k adds in Q2 23 vs 316k in Q2 22), show cable is holding its own against fiber (or at least in line with historical trends). My suspicion is Charter’s defense is starting to work (aggressive customer retention tactics). If you’re an overbuilder, do you want to go build where a competitor is going to move quickly and aggressively to defend? Smaller overbuilders are on a short leash with increasing costs, interest rates, and the recent WSJ lead cable article; slowing fiber adds with an expanding footprint won’t go down well (although I will say some of the prices for fiber assets are getting very cheap (FYBR 0.00%↑ and T 0.00%↑).

FWA moderated slightly but continues to eat the majority of broadband connects. I went to Verizon for a new phone recently and asked about FWA (it was advertised in the store), and their response was they don’t see many customers choose FWA if we have a wired option available (i.e., Fios). This is an anecdote I know, but this mirrors my thinking. The internet is gateway to the modern world, and a wired connection is just a better way to deliver consistently fast internet.

But the data doesn’t lie, FWA is a popular option for a lot of people. Do I think most of the connects are suburban families of four, switching from cable providers like Charter and Comcast? No. But are they taking potential gross adds from DSL/copper, apartment complexes (MDUs), price sensitive customers, and even expanding the TAM in some cases (garage, construction site etc.)? I do.

One caveat I always make on FWA is T-Mobile doesn’t disclose residential vs business. Using Verizon as a proxy, the skew is ~60/40 residential (wired broadband is closer to ~90/10). Doing this for T-Mobile would reduce their headline adds by ~200k this quarter.

Bottom line, Charter showed resilience in their core footprint during a weaker seasonal period, continued growing mobile and now has >10% of their customers signed up (~2 lines a home). If you think the broadband end game is a duopoly vs fiber (FWA stays around the edges), being the incumbent and driving mobile penetration puts Charter in a solid competitive position.

The Bear Case

I want to spend some time this quarter looking at some of the key bear case points:

Entering investment cycle with DOCSIS 4.0

Capex elevated from low IRR rural projects

Lower free cash flow and slowing buybacks

Low value mobile adds that lose money

Losing share as fiber overbuilds mature and FWA continues picking up price sensitive customers

DOCSIS 4.0

The cost of a DOCSIS 4.0 upgrade appears to be ~$100-200 a passing. Charter has estimated $100 (CMCSA 0.00%↑ is closer to $200), but it likely ends up costing more with inflation and BAU overruns. They’re also upgrading different portions of their footprint with different capabilities; 35% will have spectrum extended to 1.8GHz, with the remaining 65% extended to 1.2GHz. From a speed perspective, they’re going to be able to offer at least 5 GB down and 1 GB up across 85% of their footprint (other 15% will be 2x1), for ~$5.5bln, with the upgrades complete by the end of 2025. This should be plenty of performance for a “normal” internet user and provide another decade of runway for the network. I’d prefer these upgrades early; the big risk for cable is they fall behind customer requirements and fiber becomes a differentiated product (i.e., you can’t play in the metaverse if you don’t have FTTH); if this happens the duopoly thesis starts to fall apart. These upgrades prevent that, with ~30x improvement in upstream speeds. Cash flow will be depressed for a few years while the upgrades take place (~$2bln a year for 3 years), and I’d consider the upgrades “maintenance capex” in the sense that they’re not going to bring much in the way of growth. But I don’t see this as thesis destroying, and normalizing this capex over a 10-year investment cycle is reasonable imo.

Rural Capex

Full disclosure, I was never a huge fan of the rural upgrades and bears point to inconsistency of the ~$3-4k per passing cost (post subsidy) for rural buildouts, and then to cablecos claims that fiber builds are uneconomic at ~$1k per passing. While a reasonable starting point, this comparison, without context, is lazy. A final penetration figure for rural appears to be ~70%+ with a monopoly market. Charter is currently getting ~40% penetration in just 6 months. For a fiber overbuild, against an established competitor, ~40% is the terminal penetration goal (4-5 years after construction). There’s also some long-term upside as you’re building a significant amount of new network miles that creates optionality (new neighborhoods built etc.). I’m not here screaming that rural builds are incredible ROIs, but the $3-4k per passing number needs additional context. My hope is Charter can extract better economics from the next round of government funding (BEAD) as they have proven themselves a reliable partner.

Depressed Cash Flow & Buybacks

All this investment (D4.0 and rural) has led to depressed cash flow and a reduced ability to buyback shares. Cash flow is down mainly due to a ramp in capex, increased interest expense, as well as Charter becoming a full taxpayer over the last year. But looking at the cash flow yield and saying it’s <5% is not appropriate, there’s some justifiable normalization. Charter’s cash flow will decrease from ~$8.7bln in 2021 (pre-rural build), to ~$3.5bln in 2023 (est.). The normalized cash flow number is somewhere between those two; where is up for discussion, but $3.5bln is not the number. My guess, we’re looking at >$7bln normalized (mainly adjusting for line extensions).

I covered my changing thoughts on the buybacks in a previous update. The mechanical nature of Charter’s buyback is theoretically sound, but in practice it leads to the classic buyback issue… more buybacks at higher prices (when you’re gushing cash, shockingly, valuations tend to be higher). Now the stock is down at ~7x EV/Ebitda and buybacks are down (massively)! The lower price still means they’ll eat ~4% of the business in 2023 for ~$2.5bln, but you look at 12% for ~$15bln in 2021 and it’s tough to get excited. However, the current price makes it more likely we’re satisfied with the buybacks over the next couple of years (even if smaller dollar value).

Low Value Mobile

Next, bears point to consistent losses since cable launched their mobile product in 2017/18:

“it’s a money loser that’s shown no signs it will ever be profitable. The offload strategy (through CBRS spectrum) has been in “testing” for years. Current adds are inflated from free lines and churn will pick up when they switch to paying.”

My response to this is let’s say all this is all true, is wireless still valuable? I would argue yes, and in a big way. To explain why, we need to start with broadband.

It’s hard to get a straight answer for what true broadband margins are, but general consensus has them >50%, and as high as 80%. I wrote an article a few months ago talking about how media companies were essentially subsidized by cablecos over the last 10 years, and how the end of the bundle isn’t all that bad for cablecos. Broadband is/was the golden goose, and cablecos gave up a lot to keep subscribers (i.e., ran a video product for very low margins).

Mobile won’t get the same penetration as video, maybe ~20%, but a mobile subscriber will reduce churn significantly more than video. The classic thinking behind the original broadband bundle was let’s get people signed up for multiple products and they’ll be less likely to churn! Simple. The problem was if you switched from Spectrum to Fios, they would offer the exact same services, reducing friction and the value of the bundle. There might be slightly more friction now with some providers pushing you towards an MVPD partner (e.g., YouTube TV), but in general you can switch them all at the same time.

Mobile is a different. If Spectrum or Xfinity can get you to sign up for mobile, they’ve added significantly more friction than other bundled services. First, the provider you switch to (Frontier, Lumen etc.) might not offer mobile, so you’ll have to find another provider for mobile and sign up separately. Even if they do offer both services, they’re not necessarily set up for a mobile and internet bundle (you’ll also have to port your number which adds time an effort). Verizon, for example, requires you to speak to separate divisions if you have phone or internet questions (they also have separate retail stores). Humans are lazy by nature and switching is already hard enough; I think voluntary churn for mobile subscribers will be significantly lower.

Mobile also helps reduce the chance of churn if a customer moves home. Most moves are intrastate and ~50% are crosstown, meaning it’s likely that a customer stays in a cable providers’ footprint. The inherent characteristics of a wired connection mean cablecos effectively have to reacquire a customer every time they move. Mobile helps here by keeping a customer relationship “live” when they move.

So, even if you think mobile will continue to be a money loser long-term (I don’t), I think the churn benefits still make the product a net positive (I’ve written in more detail on wireless in another article where I discuss the unique MVNO deal and potential margins for mobile).

Broadband Share Losses

This is really the crux of the cable thesis. How much share will cablecos lose as fiber increases their overlap and FWA continues growing? I look at is as follows (assuming 0 footprint expansion for now):

Charter has ~55mm passings (~10% business passings), fiber overlap is currently ~45% and is expected to grow to ~60% over the next 5-years. If you assume all new fiber passings are built and mature in 5-years, we have ~3mm more fiber subs in Charter’s footprint.

Note: this is a simplistic assumption as it assumes all current fiber passings are mature (not true), but also assumes they all mature instantly post build (not realistic).

FWA is tough to predict, but Verizon and T-Mobile are targeting ~12mm connections combined by the end 2025 and have been pretty coy about growth plans post 2025 (I’m going to use 2025 target for this scenario). Charter covers roughly ~1/3rd of U.S. passings, so let’s call it ~4mm FWA subs across the footprint, ~3mm more than now.

So, assuming fiber and FWA hit their targets, we have ~6mm new connections in Charter’s footprint. Where will they come from? Well, overall broadband penetration isn’t going to help much, with penetration now at ~90% (was ~70% in 2010). Maybe we get ~500k-1mm from another percent or so of increased penetration.

For legacy telcos that disclose their Copper penetration, it’s usually ~10% (and declining). Copper covers most of Charter’s footprint, but it gets a bit messy with fiber overbuilds and the start of decommissioning projects, so we’ll say ~7% of Charter’s footprint is currently signed up to copper, ~4mm connections. How many copper subs will there be 5 years from now, I don’t know but I’d guess a lot of them will be gone. So, let’s say there’s 1mm left 5 years from now. That gets us to ~4mm (1mm from increased penetration and 3mm from legacy telco), implying that ~2mm subscribers would come from cable.

I’m aware this scenario is very rough, but I think it’s directionally correct in that it shows what happens if fiber and FWA hit their targets and cable doesn’t expand their footprint. If this happens we’re looking at Charter losing ~7% of their subscribers. Once you add in Charter’s expanding footprint (~1mm passings a year), this likely leaves us with flat subscribers in a bear case, ~5 years from now.

Now the pushback is cable penetration will continue dropping post year 5 (secular decline and worthy of legacy telco multiple). Well, the economics of overbuilding the last 40% of the U.S. is significantly worse than the first 60%. Focus for fiber has, rightfully, been areas with high amounts of homes per square mile and aerial wire. Lower home density and buried wire is going to mean slower and costlier build outs.

Fixed wireless has well documented capacity limits, and with broadband data demand growing in the mid-teens (doubled since 2018), I don’t think it’s controversial to say the growth prospects for fixed wireless 5-years from now will be significantly lower (after 12mm connections, spectrum sales, and a merger than created significant additional spectrum).

Summary

This one went long, but to summarize, it was a good quarter for Charter. They're showing they can hold their own vs fiber and fixed wireless. The big risk is still obsolescence imo, which the D4.0 upgrades will significantly reduce. If you don’t think cable is obsolete in ~10-years, the bear case doesn’t appear that scary.