Q4 Cableco Update

Some quick updated thoughts on cablecos after Q4 earnings. This post will provide updates on CHTR, CMCSA, CABO, and ATUS.

Slight change this quarter, I’m going to split the update into two sections; I’ll do cablecos in this update and telcos in another one later this week. Companies I’ll cover in this post:

Charter

Comcast

Cable One

Altice

Charter CHTR 0.00%↑

We’ll start with Charter (my beloved ex). I sold after Q3 earnings (can read my reasons for selling here), the tl;dr was:

Comcast’s negative broadband connects during a seasonal tailwind (Q3) pointed to larger structural headwinds.

FWA has shown it’s an acceptable option for a significant portion of the population.

Margins haven’t expanded as video rolled off (key part of my original thesis).

Management.

We’re now one quarter removed from my sale, and I haven’t changed my mind on the concerns I originally listed; Charter is now also dealing with their own broadband losses (stock ~$300).

They lost ~61k broadband customers in Q4 but the losses in Charter’s core footprint are closer to ~95k if you normalize for ~34k rural connections. This is even with their SpectrumOne promo still running ($50 for a mobile line and internet). Management pointed to increased competition from fixed wireless and overbuilders, along with some Disney dispute related churn, but I’m shocked at how poorly they’ve performed relative to Comcast.

Winfrey obviously became CEO at a difficult time, but his communication has got to be better. He tried his best to take responsibility for the poor performance, saying “I own that” at the beginning of the prepared remarks, but a few mins later decided to blame everyone else…

“Ultimately, the speed at which we can return to a more normalized broadband growth rate hinges on the assumption that our competitors capital is not limitless for poor ROI projects and, frankly, our execution on our strategic initiatives.”

This comment is confusing; fixed wireless requires very little (incremental) capital from wireless companies, they’re building out 5G networks for their core wireless offerings, so I don’t think he can be referring to that (or at least he shouldn’t be). But fiber isn’t the key reason they’re losing broadband subs, he even said as much:

“Overbuild impact tends to be limited to a few percentage points of Internet penetration during the first year of a new overbuild vintage coming online. It's painful, but it's tied to the pace of overbuilt. We don't see overbuilders reaching their penetration and ROI goals now -- within our footprint now or in the future.”

These explanations, when put together, don’t make much sense to me; either way, management has got to do a better job at communicating when it comes to the current competitive environment (I have less of a problem with their communication on capex and D4.0 network evolution).

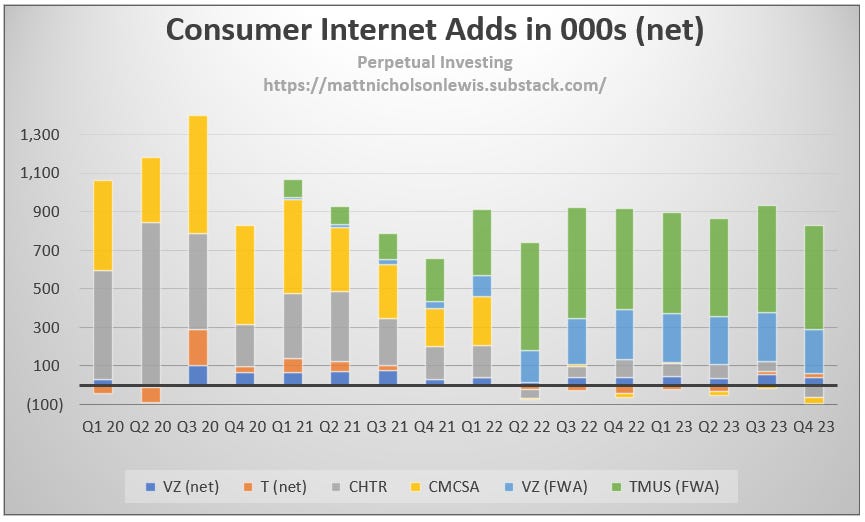

*T-Mobile adds include business (they don’t disclose separately)

Fixed wireless continues to dominate broadband adds, but T-Mobile did disclose they expect their connection growth to slow as they switch focus to ARPU. This is obviously good news for cable as it points to the capacity factor showing up, but I’m not sure it’s all good news. Verizon got access to all their C-Band in late 2023, so they should have plenty of capacity as they continue their 5G buildout, and the demand for the product still appears strong (if you’re looking for more detail on FWA, check out my three-part series).

The business is also facing some other headwinds:

ACP funding runs out in Q2, and Charter reportedly has ~4mn customers on the program (provides customers up to $30 a month off their bill). Charter says most of their ACP customers were already customers beforehand, but even if a small percentage disconnect when the funding ends, it could be a difficult year for broadband sub growth.

They’re still trying to understand the best way to compete against fixed wireless. The lack of a wire to the home is a disadvantage quality-wise, but it has created an advantage where cablecos aren’t sure which locations they’re truly competing in (availability can change by the day).

Jessica Fischer, CFO, disclosed they were seeing continued weakness in connections in January (similar to December).

They do have some tailwinds such as lapping labor cost adjustments (margin expansion), the election year advertising bump, and continued momentum in mobile (~550k adds in Q4), but the key is to get back to broadband connection growth. The business trades <7x EV/Ebitda, so if they get back to growth, the stock does very well from here. My thesis was ~400k broadband adds a year with moderate ARPU growth… I don’t see either of those anymore — big gains can be made in situations like this, but I’m okay sitting this one out for now.

Comcast CMCSA 0.00%↑

Comcast has taken a slightly different approach to increased broadband competition. They’ve accepted some broadband customer losses, and instead focused on keeping a flat (to slightly down) customer count with moderate ARPU growth. This has meant ~3-4% broadband revenue growth and solid margins — their domestic cable margins are ~46%.

I originally preferred Charter’s more aggressive competitive strategy (e.g., SpectrumOne promo); keeping a customer is cheaper than acquiring a new one, and the incremental cost of servicing that customer is pretty low. This works well vs fiber — offer them a discount to stay for another year and hope they’re too lazy to call up to cancel again in 12 months (if they do, say well played and offer another discount).

Against fixed wireless, this strategy isn’t as effective. Fixed wireless is a low-cost product as they’re already building out their networks for their core wireless service (i.e., wireless home broadband is incremental revenue and requires very little additional capital). The key constraint is capacity, so aggressive retention tactics just mean T-Mobile or Verizon can offer it to the person next door if an aggressive retention offer is accepted (Charter has just lowered their ARPU and the wireless provider still has the capacity to use on the next potential customer); fixed wireless providers will do this until they run out of capacity.

Comcast’s strategy is currently working better (put up less of a fight), and likely continues to until cablecos get their arms around fixed wireless competition. This is a quote from Charter’s conference call, but I think highlights the issues cablecos are facing:

“It's very difficult for us to sit back and take a look at the geographic footprint of fixed wireless access because it almost changes by the day, in terms of sector availability on radius in terms of capacity and where they're actively marketing and where they're not. And then you have the additional rural footprint versus urban and suburban and what would be off-footprint for us versus on-footprint. And the split between residential and commercial, which makes it pretty difficult to mathematically cascade that into an impact for us.”

The other businesses make Comcast a little less appealing to me (more work and I’m not a fan of the networks and Sky), but I think they’re managing their cable business well.

Cable One – CABO 0.00%↑

I say the same most quarters about Cable One and my opinion hasn’t really changed; I’ll keep this brief (link to original write-up from 2022 — still stands up well imo).

Their broadband ARPU is ~20% higher than peers and they’re dealing with overbuilders in their 2 largest footprints (Boise & Gulfport). Fixed wireless is less available in rural areas (CABO puts it ~35%) but when it is available, they have more capacity and it costs ~$30 less (CABO has piloted a $25 plan to compete with price sensitive customers). They still need to buy the remaining 55% of MBI based on what I’m guessing is a rather high multiple of Ebitda (agreed to in late 2020), after buying 45% for ~$575mn. They’ve made some nice capital allocation moves, issuing ~$920mn of convertible notes in 2021 (~$2.2k convert price) at <1% avg. interest rate; management is easy to root for, but I don’t see value here, even at <7x EV/Ebitda.

Altice – ATUS 0.00%↑

Similar to CABO, my opinion hasn’t changed much here. This is a business with >$24bln in net debt (~6.8x leverage – Charter EV/Ebitda multiple is ~6.5x…), losing subs, declining revenue & Ebitda, generates very little free cash flow, and has underinvested in their footprint over the last decade (portion of their Suddenlink footprint isn’t even upgraded to D3.1). They’re issuing 5-year debt at ~12%, and with their current average life of debt at 5 years (~6% cost), I don’t see how this gets any better. The CEO is doing a decent job, but I don’t think it will be enough. Maybe Drahi will take this private and someone makes a killing, it won’t be me though…

Good update, thank you Matt.

Great update, as per usual. Thanks, Matt!