Q4 Telco Update

Updated thoughts on a few telco names after Q4 earnings: $fybr, $t, and $tmus.

Frontier FYBR 0.00%↑

If you are bullish fiber, Frontier is the best way to make that bet imo. You get a proven management team that is executing the 2nd largest fiber overbuild in the country (AT&T is the biggest but not pure play fiber). The stock hasn’t done great since it emerged from bankruptcy in 2021, but a lot of that can be put down to being a levered equity stub in a rising interest rate environment. Overall, they’ve done a good job on their 2021 investor day goals despite the macro headwinds. Let’s take a quick look at some of their key targets and how they’ve done as of Q4 23:

10mn fiber passings by FY25 – 6mn new passings

At the time of the investor day Frontier had ~15mn total passings (fiber & copper), with a plan to get to ~4mn fiber passings by the end of 2021 (base footprint & Wave 1). Management then planned to build ~6mn new fiber passings for a total of ~10mn — the remaining ~5mn copper passing were considered uneconomical for fiber and put under strategic review.

Fast forward to the end of 2023 and they’ve upgraded ~2.5mn passings, but the build pace will be slower than anticipated for FY24-25. Given the supply chain and macro headwinds, I still think management can call this a success (they’ve been less impacted than other overbuilders like Lumen and Consolidated). Assuming ~1.3mn passings a year cadence, that would be ~9.1mn passings at the end of 2025 (~900k down on original target).

Cost per passing ~$1k

Management forecast that Wave 2 costs would be ~$1k per passing. I’m usually skeptical of these cost per passing targets; management teams get to make a lot of assumptions and are incentivized to disclose the lowest cost possible. I’ve discussed this in other articles, specifically with CNSL 0.00%↑ (I thought their cost per passing estimates were laughable), but I like to do some back of the envelope math to see if I can reconcile management’s cost per passing number.

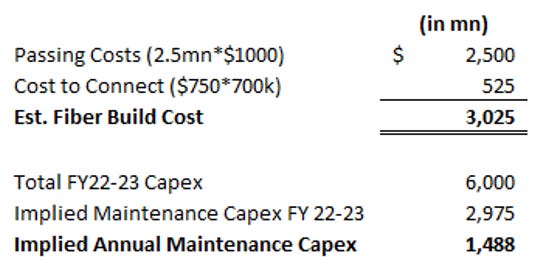

Frontier had capex spend of ~$6bn in 2022-2023. They’ve built ~2.5mn fiber passings and connected ~550k customers at ~$750 cost to connect (I’m going to say 700k gross adds to account for churn and some copper adds).

Their avg. capex before and during bankruptcy was ~$1.2bn (vs the implied $1.5bn in my rough calc above). Add in some inflationary impact and I think Frontier’s estimates roughly match their actual capex spend (there are some other moving pieces like the sale of their Northwest footprint and fiber is supposed to be cheaper to maintain, but I’m going to offset that with some expected underinvestment during bankruptcy).

Penetration & Fiber Customers

At the investor day management’s goal was to increase penetration in their base footprint to ~45%; for new builds it was to penetrate ~20% for the first 12 months, ~28% at 24 months, and ~35% at 36 months.

As of Q4 23 they’ve increased base footprint penetration to ~44.5%, up >300bps since FY20, and they’re hitting their penetration targets for new builds. I’ve always thought the 36-month and terminal penetration targets (~45%) were significantly harder to achieve than the 12/24 month targets, and that appears to be the case with their 2021 build (~600k passings) at the low end of the 24-month range. We’ll have to see how their 2022 & 2023 cohorts do as they mature, but there’s no denying management has done a good job so far.

I don’t own Frontier, mainly because I think the grind from 25-45% penetration is harder than the market thinks (I did consider buying when it dropped to ~$15 on the lead story though). I’ll finish by saying it again, if you’re bullish fiber, and I’d consider bullish fiber as getting to ~40-45% penetration 5 years post build, Frontier is the best way I currently see to make that bet in the market (link to original write-up from July 2022).

AT&T T 0.00%↑

I’ve owned AT&T since early 2023 and I’m about even on the stock including dividends); I still like the set up:

Trades at ~6.5x EV/Ebitda and ~15% fcf yield (~$17-18bn NTM fcf on ~$120bn market cap and ~$290bn EV).

5G investment cycle is slowing — capex intensity decreasing.

Focused on debt reduction — I like the combo of a low EV multiple, consistent cash flow, and a focus on reducing debt (goal is to reduce leverage by half a turn by 2025 — >$20bn).

Simplified business post WB spin — focused on 5G and fiber.

~6.5% dividend yield to sit and wait.

AT&T is priced as if postpaid phone growth slows (significantly) and ARPU stays flat. I think postpaid phone growth continues to slow, but AT&T should continue adding connections; ARPU growth is where I think the market is perhaps missing something. It’s true there’s been pretty much no ARPU growth over the last decade for wireless players, but there’s a few things that have changed.

The market has gone from 4 MNOs to 3 (Sprint/T-Mobile merger). Cable is aiming to become the 4th big player via a hybrid MNO, but we haven’t seen how a 3 MNO market competes in a normalized growth environment. I would argue a subscale value provider, like Sprint, is more incentivized to undercut on price than cablecos operating as an MVNO. With slowing growth post-pandemic, I think we see carriers begin to focus on ARPU (my T-Mobile write-up has some more detail on wireless market trends).

We’re already seeing this play out, AT&T and Verizon are running their classic playbook — launch a new plan and then force migration through price increases on legacy plans. Even T-Mobile, the famous Un-carrier, has hinted they will begin to raise prices.

There’s also a need for the industry to earn a return on their massive 5G investments. A lot of 5G use cases (driverless cars, VR etc.) have failed to take off, with the only incremental monetization coming via fixed wireless (which AT&T hasn’t even aggressively pushed). The only option left is to push price on traditional wireless plans.

Fiber continues to perform solidly, with ~30% penetration despite building ~8mn passings in the past 3 years (26mn total passings). It’s not a key to the thesis, but continued momentum in fiber will help.

I think this creates a nice set up and solid returns going forward. The one problem I’ve found is that I’m invested in AT&T… This means I get to watch new ways for a stock to go down. Whether it’s a story of how legacy lead cables could lead to liabilities of up to ~$60bn, or a mass network outage that upsets customers and requires refunds. I’m kidding (kind of), but I still see value here.

T-Mobile TMUS 0.00%↑

I own some T-Mobile; the thesis is similar to AT&T, but with a higher growth outlook and premium valuation of ~9.5x EV/Ebitda (can read original write-up here). They’re coming to the end of their merger integration and management has switched focus to returning capital via buybacks and dividends (recently initiated).

They’re showing signs of rolling out price increases (outside of their failed attempt during Q4); a quote from their Q4 cc:

Response to question from Craig Moffett on potential ARPU increases:

“Customers are getting 3x more data than just 5 years ago, and at 4x greater speeds industry-wide than 5 years ago…if there are ways for us to find optimizations in terms of how we deliver that enormous value so that we can be more competitive and more efficient at how we operate, including looking in our rate card and looking at our rate plans and looking at our policies and procedures, we'll find those opportunities.”

They’ve already increased prices for their fixed wireless service, bumping the price from $50-60 and are starting to limit speeds if users consume >1.2TB in a month. When the value provider begins to talk about pushing price, I think it’s a good bet we see some.

The business continues to see solid tailwinds in their rural and enterprise segments (postpaid and fixed wireless); their 5G network quality now allows them to compete in areas they previously had no right to win. They’ve increased their market share in rural locations from ~13% in 2021, to ~17.5% at the end of FY23 (aiming for ~20% in FY25). The goal for the enterprise business was to grow from ~10% share to ~20% in 2025, management says they’re still on track to achieve this target as well.

I see continued Ebitda & fcf growth, with large capital returns. The biggest risks are a significant slowdown in the wireless market (risk for all players), or management tries to do something with all their newfound cash flow (e.g., acquisition of fiber player at a significant premium). Something to watch closely, but I still like the stock.

I enjoy these round-ups a lot. Thanks for doing them!

Hi Matt,

quick question:

Frontier keeps mentioning that between 2021 and 2023 they have achieved $500M in cost savings. I don't see it in their financials. Do you?

Tks/Tom