WK Kellogg – Spin-off

KLG, the unwanted spin-off from Kellanova (formerly Kellogg's). The market is concerned about management and capital allocation, but the cereal category is the reason I passed.

Mixing it up a bit with a look at a spin-off from late 2023. Part 3 of the FWA series is coming soon, but I’d been looking at KLG 0.00%↑ after it dropped from ~$17 to ~$10 (it’s back up to ~$13), so figured it would be good to get some thoughts down.

TL;DR

I ended up passing on WK Kellogg for one key reason, I’m not sure they can sustain flat revenues in a declining cereal market. Investors are concerned with management and capital allocation – I understand this concern (the CEO seems like he’s already dying to do an acquisition) – but if you believe in the supply chain investments and revenue stays roughly flat, you’re looking at a stock trading ~4x EV/Ebitda on 2027 numbers (i.e., there’s ~20% IRR to be made over the next few years based on execution alone). I just don’t see how the cereal category holds up – the consumer continues to move away from the product, and aggressive price increases have reduced demand.

The Situation

Kellogg’s split into two companies in the 2nd half of 2023. The reason behind the spin was to separate their secularly challenged North American cereal unit, now WK Kellogg’s KLG 0.00%↑, and highlight their fast-growing snack business, now Kellanova K 0.00%↑ (e.g., Pringles, Rice Krispies Treats, Eggo, Pop Tarts, Cheez-IT). Management originally planned to split into three companies, with plant-based brand MorningStar Farms also spinning off, but this was scrapped after comps for competitors, such as Beyond Meat, dived after the original announcement.

This post is going to look at the abandoned cereal business, WK Kellogg’s (from now on referred to as Kellogg’s). Kellogg’s will focus solely on the North American cereal market – U.S., Canada, and Puerto Rico – selling iconic brands such as Frosted Flakes, Special K, Fruit Loops, Corn Flakes, Rice Krispies (only cereal), and Mini Wheats. Kellogg’s sells 9 of the top 20 cereal brands.

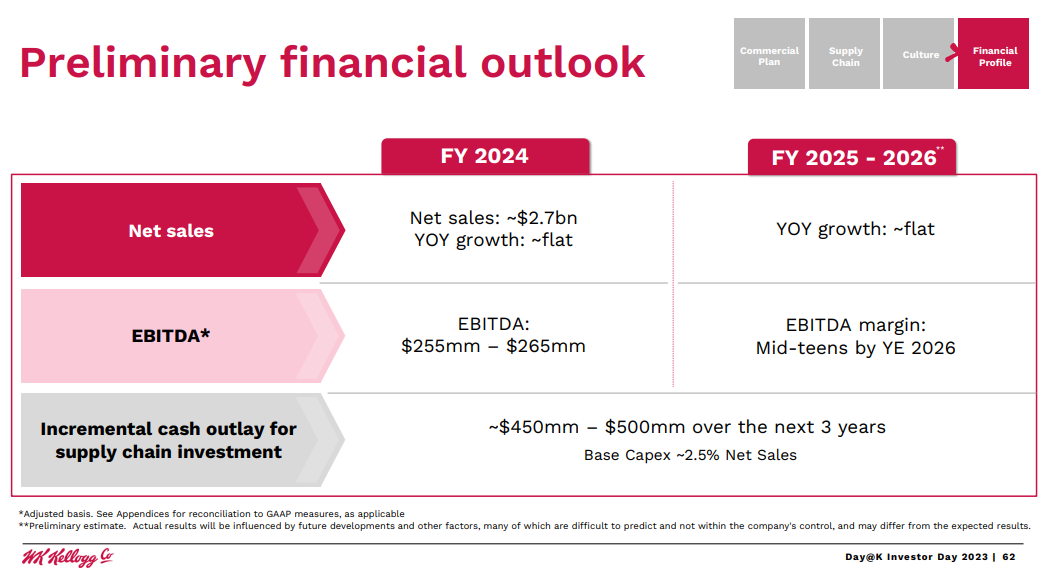

Kellogg’s is the #2 player in the ~$10.5bln U.S. cereal market with ~26% share, behind General Mills G 0.00%↑ at ~34% (Post Holdings POST 0.00%↑ is #3 with ~18%). Management is projecting flat revenue over the next 3 years, with volume declines offset by price increases. Ebitda margins are expected to be ~9-10% in 2024, with cash flow flat to negative as the business invests ~$600mm to modernize their supply chain and complete the spin-off.

Post this investment cycle, management projects they’ll generate ~$2.7bln in revenue, ~$390mm in Ebitda (mid-teens margin), with ~75% free cash flow conversion (~$290mm). The business trades at ~4.5x EV/Ebitda, or ~25% cash flow yield based on these numbers. For capital allocation, management has committed to paying an annual dividend (~4% yield – funded by debt initially) and has said they are open to M&A in the future.

This is a classic good-co/bad-co spin-off; Kellogg’s, the bad-co, has been loaded up with ~$550mm of net debt, and leverage is expected to rise through 2025 as the supply chain investments are made. However, if management executes and meets their projections, the stock could generate ~20% IRR (incl. dividends).

A few things need to happen to get this return:

Management investments yield the expected margin expansion (~500bps).

The cereal category returns to its pre-pandemic trends of low-single-digit declines – Kellogg’s maintains flat sales by taking share.

Management allocates capital effectively – this is more important post supply chain investments but given it’s a key market concern, we’ll address it in this write-up.

Margin Expansion

Management held an investor day in August 2023, detailing their plans as an independent business. The strategy was based around 3 pillars: a focused organization, modernized supply chain, and a winning culture.

The key headline was a ~500bps increase in margins, mainly through modernizing their supply chain. Management pointed to a chronic lack of investment in their 6 manufacturing facilities as the key reason for this opportunity; they plan to invest ~$450-500mm over 3 years.

Skepticism is warranted, but the numbers are reasonable; the investments are projected to generate ~$100mm of incremental Ebitda, a solid return (~5-year payback post-build) but not crazy enough that you question why the previous business didn’t make the investments. Mid-teens Ebitda margins would still be below competitors; General Mills GIS 0.00%↑ and Post Holdings POST 0.00%↑ generate closer to ~18%.

Management disclosed they’ve operated at ~35% gross margin as recently as 2018 but they’re currently at ~29%. This is due to older facilities operating at significantly higher costs than more productive plants, as well as lost operating leverage from volumes declines; their lowest cost facility currently produces cereal ~50% cheaper on a per kilo basis. They’re in the process of expanding more efficient facilities – ~$40mm invested in Belleville, Ontario plant – and plan on moving production to efficient plants.

They’ve also dealt with significant supply chain issues over the last few years. First, the pandemic stretched their supply chain as a surge in demand forced them to focus on larger SKUs, at the expense of share. Then, in July 2021, a fire in their Memphis facility exacerbated the challenges as well as stopped the business from building inventory ahead of a ~1400 worker strike – the strike impacted 4/6 plants and lasted ~2 months (October – December 2021); normalization of these pressures should help margins.

Put this together and the business has dealt with underinvestment, lack of executive interest/focus, supply chain issues, and two significant one-off events (fire & strike). All these have created headwinds to Kellogg’s cereal margins. Post investment margins will still be >300bps lower than peers; I think a 500bps margin expansion is very achievable.

Cereal Market

The second part of Kellogg’s plan calls for flat sales over the next few years. This is where the opportunity falls apart; the U.S. has been slowly moving away from cereal over the last few decades. The rise of frozen breakfasts, eating on-the-go, or even skipping breakfast in favor of intermittent fasting have eroded cereals legacy dominance. The pandemic helped slow this trend with industry unit sales up ~5% in 2020, but in 2021- and 2022-unit sales were down ~8 and ~4%, respectively. Younger generations are interested in healthier breakfast choices with less sugar and milk, a key ingredient for cereal, has fallen out of favor with Gen Z and Millennials.

*Chart created by author with data from Form 10 and 10-Q

Cereal makers have responded by pushing through price increases to maintain sales numbers and margins. Kellogg’s has increased prices ~30% since 2020, with volume down ~25%. Cereal is not the tobacco industry, there’s a limit to the price increases consumers are willing to take before they’ll try a cheaper option – private label has seen a small increase in share as cereal makers have pushed price.

Cereal manufacturers are predicting a return to pre-pandemic trends, with sales declining ~LSD. Kellogg’s is expecting flat sales as they take back the share lost from their fire and strike issues. I just don’t see a high likelihood of them achieving flat. Consumers are moving away from the category for a variety of reasons, and a key selling point (price) has been pushed hard since the pandemic.

Capital Allocation

This is the biggest unknown. Gary Pilnick, CEO, has a background as a lawyer and in corporate development, not your usual operations type experience. He appears to understand this is a return of capital story, initiating a dividend despite >$500mm of investment and has consistently reiterated the team’s focus on returning capital to shareholders. But he seems overly interested in pursuing some type of M&A down the line:

“We're going to be focused, integrate our business and invest in this first horizon, driving a much stronger company with a more reliable supply chain, a stable top line generating substantially more profit from every box of cereal sold while growing our category share. When we come out of this horizon, we'll be a strong company with higher cash flow to pay down debt, invest back in our business and return capital to share owners while also exploring other opportunities like M&A, joint venturing, licensing... The second horizon is about leveraging our foundational cereal business to grow beyond cereal and accelerate our top line, building on our iconic portfolio of brands and our strong momentum coming out of that first horizon.”

This quote doesn’t seem like much, but when someone, unprompted, says “hey once we finish with this task we’ll consider M&A”, it’s probably a good bet they’re counting down the days until they can do it. It’s not that surprising given his background in corporate development, the quote “To a man with a hammer everything looks like a nail” comes to mind… I consider this less of an issue than the market though; if this business is generating ~$400mm of Ebitda in 3 years, this stock works.

Summary

I like researching this type of opportunity, an easy-to-understand business with clear and simple turnaround plan; I ended up passing but I think you can turn over a lot of rocks by looking at these types of situations.

If the cereal category and Kellogg’s can show flat sales with only moderate price increases (~ inflation), I’d be very interested at the current price (~$13). I see a good chance of their margin initiatives working, and while I agree with the markets’ capital allocation concerns, there’s a potential ~20% IRR to be made by just betting on the first leg of this journey.