Activity

Add: Carnival Corporation CCL 0.00%↑

Add: Royal Caribbean RCL 0.00%↑

Add: Consensus Cloud Solutions CCSI 0.00%↑

Sold: Remaining Charter CHTR 0.00%↑ position

Portfolio

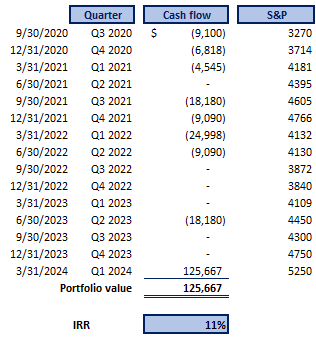

Current portfolio (with avg. cost), along with timing of cash flows from a hypothetical $100k portfolio.

IRR is back up to ~11%, driven by Marathon Petroleum MPC 0.00%↑ (my largest position at ~18%) doubling since my purchase in May, 2023. A simple thesis that has been helped by macro environment and great execution.

Returns roughly match the S&P as the market has also been on a solid run in 2024. QRTEA 0.00%↑ is still a very expensive lesson that has held back returns; I’ve actually done a pretty good job of picking winners, my hit rate is solid, but a large loss take time to overcome. Good lesson and why I don’t like YTD returns as an individual investor (I’ll say this every update).

I haven’t written about CCSI on the blog and it’s admittedly a bad company (cloud fax), but it’s trading at ~30% fcf yield and focused on buying back debt (at ~90% of par) and equity. The stock is volatile (I’m down ~30%) and it just got dropped from some indexes, but I think it’s a good bet and it satisfies my deep value itch.

I’m considering punching out of Barratt Developments after their acquisition of Redrow. They’re releasing detailed information on the deal at some point in April which I want to review before making a decision. I’m not a fan of the acquisition, but it’s more because I think the U.K. homebuilding thesis works long-term if companies simply avoid tripping over themselves. I feel like Barratt keeps finding ways to do this, and I either need to take a basket approach or reassess how I want to make this bet.

I’ve written about cruise lines on the blog (general post here and Carnival specific post here), so I won’t rehash in detail but I think capacity growth will be moderate, demand solid, which will allow businesses to reduce leverage over the next few years.

I consider MO 0.00%↑ and HRB 0.00%↑ similar bets. They’re boring businesses with low top line growth, solid ROICs, and are less reliant on the market cycle than most other stocks. The nicotine space has some buzz and upside from pouch products like Zyn and on!, but people still underestimate the downside protection from the combustible business.

I still hold a small position in QRTEA (shrunk for me by the market). I think there’s some option value there but I’m not interested in making it a large position. The leverage means a quick double is possible, but I think you should only be betting money you’re willing to lose on this type of stock (there’s reasonable odds this is a 0).

I write a lot about cable/telecom, so my changing views are out there; I like AT&T and T-Mobile as the 5G capex cycle has slowed and they’re both focused on generating cash and returning it to shareholders (reducing debt for AT&T as well).

Still like my AAL position and I think the outlook has improved since I made the bet late last year (stock is down slighlty). I’ve been looking for tickets for a few trips this summer and what used to be a ~$350 flight is now ~$500 (anecdotal I know). Planes deliveries continue to be delayed due to production issues at Boeing, pushed back by smaller airlines who are focusing on near-term cash generation (e.g., Spirit), or the Pratt & Whitney engine issue that continues to remove planes from the sky. I think big airlines are nicely positioned to take advantage of the current industry dynamic, and AAL with a young fleet should be able to generate solid free cash flow and paydown debt (which at <6x EV/Ebitda, should flow to equity holders).

I wrote about Nintendo late last year, so you can see my thoughts there. I’m happy to be patient on this one; this is a business with amazing IP, opening up to non-game monetization strategies (movies, theme parks etc.), and a changing console cycle (less volatile).

given your expertise, would be great to get thoughts\post on cogent and some of the dirt cheap foreign telecoms.